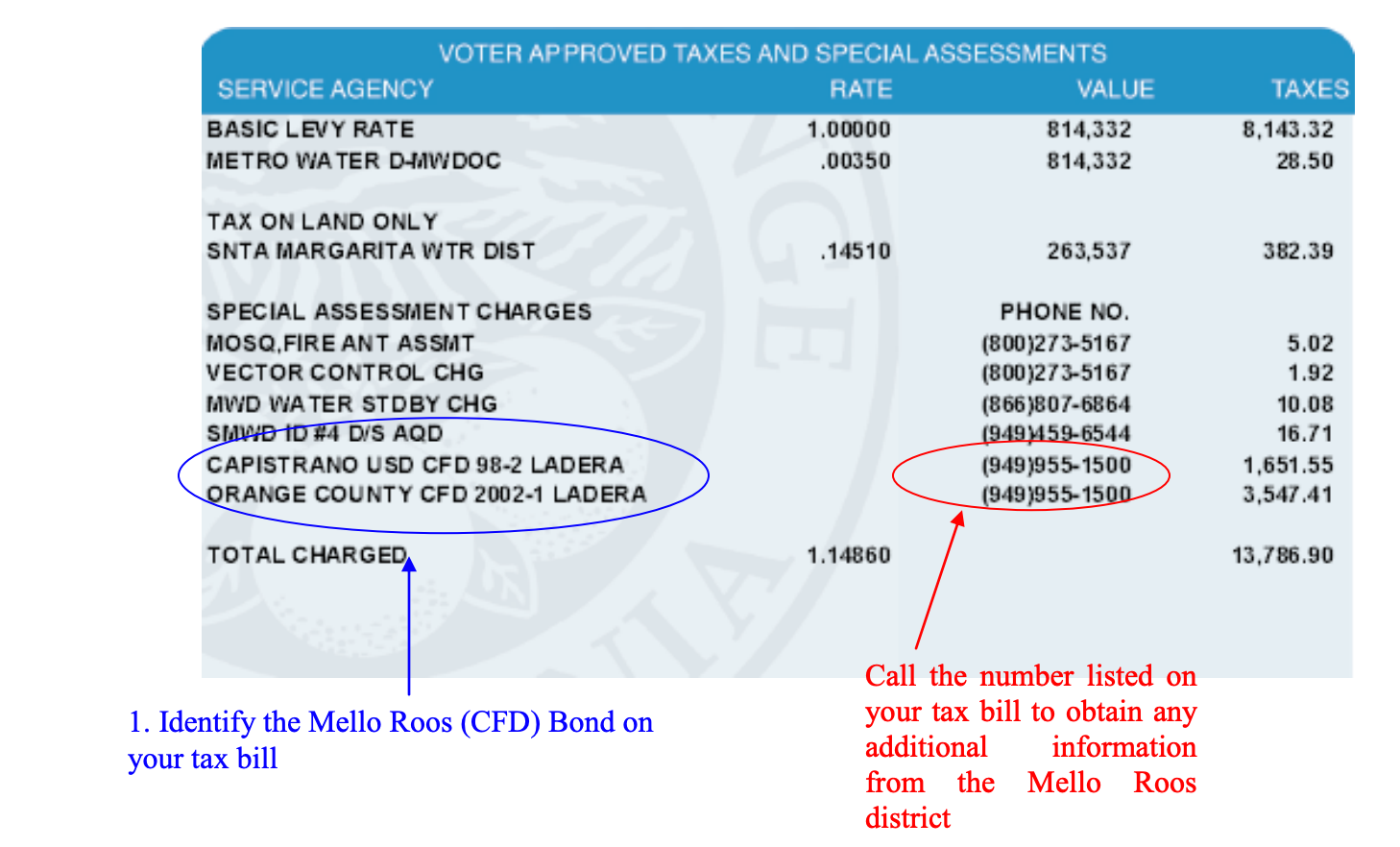

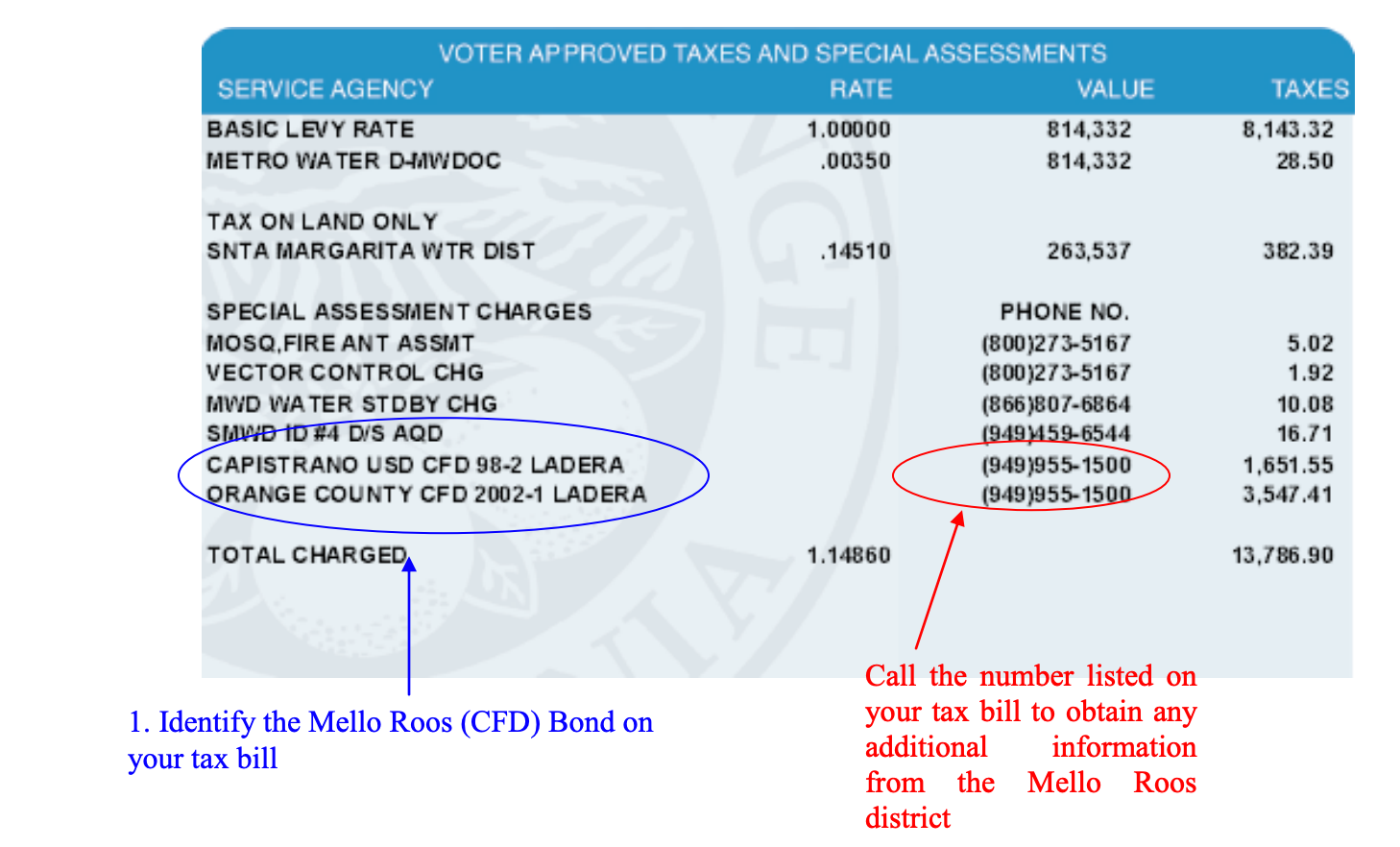

The Community Facilities District (CFD) Act of 1982, also known as the Mello-Roos Act, was enacted by the California Legislature in response to the passage of Proposition 13 to provide a flexible funding mechanism to local governments. Bonds issued pursuant to the Act can be used to finance construction as well as to acquire capital facilities. Under current law, new bonds must be approved by a vote in an election by the property owners in the assessment district. The Bonds are secured by special taxes levied on property owners and billed on the property tax bills. The County is working to make this information more transparent to taxpayers.

In Danae's words... it's a tax on top of the 1% to pay for new communities schools, curbs, gutters, etc. Most new communities will have taxes above the 1% because of this. Again, this info will be on the current tax bill so look up each address one by one to be sure.